Liveblog Archief maandag 11 oktober 2021

Markt snapshot Wall Street 11 oktober

TOP NEWS

• Merck seeks first U.S. FDA authorization for COVID-19 tablet

Merck said it has applied for U.S. emergency use authorization for its tablet to treat mild-to-moderate patients of COVID-19, putting it on course to become the first oral antiviral medication for the disease.

• Chevron commits to net zero emissions by 2050

Chevron set a target to cut certain types of upstream gas emissions to net zero by 2050, joining a list of energy companies taking steps to reduce their carbon footprint.

• China property bonds dive as Evergrande debt holders await coupon deadline

China property bonds slumped after a developer asked to delay a paper's maturity, underlining default fears stalking markets as offshore bondholders of China Evergrande Group awaited news of $148 million in looming debt coupons.

• Facebook-backed group launches misinformation adjudication panel in Australia

A tech body backed by the Australian units of Facebook, Google and Twitter said it has set up a special committee to adjudicate complaints over misinformation, a day after the government threatened tougher laws over false and defamatory online posts.

• Business jet makers look to tap surging corporate travel demand at Las Vegas air show

Planemakers are likely to unveil new orders and models at the world's largest business jet show this week as they aim to cash in on a boom in private travel, but executives warn of headwinds due to a capacity crunch.

BEFORE THE BELL

Wall Street futures were lower and European stocks were mostly in the red as concerns around inflation and the upcoming earnings season weighed on sentiment. Asian equitiesended on a mixed note, with Japan’s Nikkei closing higher on optimism over economic reopening. The dollar rose to its highest in nearly three years versus the yen, while gold prices fell. Oil jumped as an energy crisis continued to grip major economies.

STOCKS TO WATCH

IPOs

• Delimobil Holding S.A.: The company filed for an initial public offering in the United States and revealed that its revenue for the first half of this year more than doubled, as the car-sharing company becomes the latest in a slew of Russian firms targeting market debuts. Russian IPO activity is picking up pace as the global economy improves and concerns over fresh Western sanctions fade. The Moscow Exchange expects to hold 10 share listings by the end of the year. Delimobil's revenue for the six months ended June 30 came in at 4.93 billion roubles, up from 2.25 billion roubles in the same period a year earlier. Losses narrowed to 1.07 billion roubles, from nearly 2.3 billion roubles a year earlier. BofA Securities, Citigroup Global Markets and VTB Capital will act as joint lead book-running managers, while Renaissance Securities, Sberbank CIB and Banco Santander will act as joint bookrunners, Delimobil said.

Moves

• KKR & Co Inc: The firm said it has elevated its co-presidents Scott Nuttall and Joseph Bae to co-chief executive officers, succeeding the storied private equity firm's billionaire co-founders Henry Kravis and George Roberts. The transition has been in the works for years and is unlikely to surprise the firm's investors. KKR had named Bae, 49, and Nuttall, 48, as co-presidents in 2017. KKR said on Monday that Kravis, 77, and Roberts, 78, would remain involved in the running of the firm as executive co-chairmen. Nuttall and Bae face a high-stakes challenge in replicating the successful working relationship of Kravis and Roberts, two cousins who started KKR 45 years ago. Separately, KKR, Axa and Allianz will participate in an auction for a 49% stake in the fibre-optic subsidiary of Spanish grid operator Red Electrica, newspaper Expansion reported, citing unnamed sources.

In Other News

• Apple Inc: The company asked a U.S. federal judge to put on hold orders that could require it to change some of its App Store practices and said that it is also appealing the ruling in an antitrust case brought by "Fortnite" creator Epic Games, according to court filings. U.S. district Judge Yvonne Gonzalez Rogers in September largely ruled in Apple's favor after a weeks-long trial. But she did require one key concession: Apple starting Dec. 9 could no longer prohibit app developers from including buttons or links in their apps that direct users to means of paying beside Apple's in-app payment system, which charges a commission to developers. Apple said in Friday's filing that complying with the order could cause it and consumers harm. It said it expects to win an appeal challenging the order and that it wants the legal process, which could last about a year, to play out first. Epic separately is appealing the judge's finding that Apple has not violated antitrust law through its payment rules.

• AstraZeneca PLC: The company's experimental COVID-19 drug has helped cut the risk of severe disease or death in a late-stage study, the British drugmaker said, a boost to its efforts to develop coronavirus medicines beyond vaccines. The drug, a cocktail of two antibodies called AZD7442, reduced the risk of severe COVID-19 or death by 50% in non-hospitalised patients who have had symptoms for seven days or less, meeting the main goal of the study. "These positive results show that a convenient intramuscular dose of AZD7442 could play an important role in helping combat this devastating pandemic," Hugh Montgomery, the trial's principal investigator, said in a statement. AstraZeneca is submitting data from various AZD7442 studies to global health regulators, a spokeswoman said. "We'll be continuing discussions with regulators around this new data," she said of Monday's trial results.

• AvidXchange Holdings Inc: U.S. payments firm AvidXchange Holdings said it is aiming for a valuation of nearly $5 billion, after boosting the price range for its initial public offering. The company is now looking to sell 22 million shares priced between $23 and $25 each. At the top end of the newly announced range, AvidXchange will raise up to $550 million in the IPO. Earlier it had set a range of $21 to $23 per share, aiming to raise up to $506 million. The hike in price range indicates high demand among investors for shares of financial technology firms, even as volatility in the broader market forced exercise equipment maker iFIT and alternative investment technology company Allvue Systems Holdings to shelve their share sales in recent days. AvidXchange processed around 53 million transactions worth about $145 billion last year, according to its website. The company was valued at $2 billion in a funding round in April last year. AvidXchange, which is backed by billionaire Peter Thiel, said it expects to list on the Nasdaq under the symbol "AVDX".

• BioNTech SE & Pfizer Inc: Italy has decided to provide a booster shot of Pfizer and BioNTech's COVID-19 vaccine to frail people regardless of their age as well as people aged 60 and over, the health ministry said. The booster dose would be available on condition that at least six months have passed since people completed their primary vaccination cycle, the ministry said in a statement. The European Union's drugs regulator said people with weakened immune systems should get a third dose of a COVID-19 vaccine from Pfizer/BioNTech or Moderna, but left it to member states to decide if the wider population should have a booster. Beginning Sept. 20, a third dose had been given in Italy to immunocompromised people, those age 80 or over and to nursing home residents and operators, and health workers over 60 or with comorbidities or other factors leading to increased exposure to possible infection.

• Boeing Co: The Federal Communications Commission (FCC) disclosed it circulated the company's application seeking approval to launch and operate 147 satellites to provide broadband internet access for a vote. Boeing first filed with the FCC in 2017 seeking approval to deploy a V-band Constellation using low earth orbit and highly inclined non-geostationary orbit satellites "to provide high speed broadband communications." Boeing sought to operate V-band Constellation "to provide broadband Internet and communications services to residential consumers, governmental, and professional users across the United States, Puerto Rico, and US Virgin Islands." Boeing declined to comment on the FCC application circulated for a vote by Acting FCC Chair Jessica Rosenworcel on Thursday.

• Cheniere Energy Inc: China's ENN Natural Gas said it has signed a 13-year long-term deal to buy liquefied natural gas from Cheniere Energy, the top LNG exporter from the United States. This is the first major binding deal for natural gas between the two nations since a long-standing trade war which brought gas trade between both countries to a standstill before resuming in 2020. The deal, which starts in July, 2022, is for 900,000 tonnes of LNG a year and was purchased on a free-on-board (FOB) basis, the company said. Citing Cheniere Chief Executive Officer Jack Fusco, ENN said the deal is also expected to bring the third stage of Cheniere's Corpus Christi LNG plant in Texas closer to a final investment decision (FID), which is expected next year.

• Chevron Corp: The company set a target to cut certain types of upstream gas emissions to net zero by 2050, joining a list of energy companies taking steps to reduce their carbon footprint. The move to cut upstream scope 1 and 2 gas emissions comes amid rising pressure on energy companies from investors, activists and governments to join the fight against climate change and sharply cut greenhouse gas emissions by mid-century. Chevron last month pledged to triple its investments to $10 billion on reducing its carbon emissions footprint through 2028.The company expects to achieve the target through investment in renewable fuels, carbon capture technology and hydrogen.

• Credit Suisse Group AG: The GFG Alliance said it had agreed a debt restructuring deal with the deal for its Australian steel and coal mining assets, and announced plans to inject 50 million pounds into the restart of its Rotherham electric furnace in the United Kingdom. GFG, owned by commodities tycoon Sanjeev Gupta, has been scrambling to refinance its cash-starved web of businesses in steel, aluminium and energy after supply chain finance firm Greensill Capital filed for insolvency in March. The debt restructuring for its Australia assets will allow GFG to make a "substantial upfront payment" to Greensill Bank and Credit Suisse, with the balance paid in instalments until the new maturity date of June 2023, a statement from GFG said. Zurich-based Credit Suisse had previously disclosed some $2.3 billion worth of loans exposed to financial and litigation uncertainties within Greensill-linked supply chain finance funds, with some $1.2 billion of its assets related to GFG.

• Deere & Co: A majority of the company's workers voted against a six-year labor contract that was tentatively agreed with the United Auto Workers (UAW) earlier this month, the U.S. tractor maker said on Sunday. The deal over wages and employee benefits would have covered about 10,000 employees across 14 facilities in Iowa, Illinois, and Kansas. "John Deere remains fully committed to continuing the collective bargaining process," the company said, adding that operations would continue as normal. The agreement reached by UAW and John Deere on Oct. 1 was rejected by "90% of the membership", UAW Vice President Chuck Browning said in a separate statement. A strike deadline has been set at the end of Wednesday, he said.

• Exxon Mobil Corp: The labor union representing workers locked out of an Exxon Mobil Corp refinery accused the oil company of trying to "bust our union" by supporting efforts to officially remove the union with a decertification vote. Any vote would be tainted by "serious unfair labor practices," the USW said in a statement that accused Exxon of "misleading people with confusing statements regarding our union, our negotiations and the company's spiteful lockout." A majority of the plant's union members "are still with us," Bryan Gross, a USW international representative, said of a vote's prospects. The U.S. National Labor Relations Board (NLRB) said it had received a petition backed by signatures from at least 30% of workers represented by United Steelworkers union local 13-243, the minimum required to call for a decertification vote to remove the union.Meanwhile, the company said on Saturday it and the United Steelworkers union, the union representing workers locked out of a Texas refinery, discussed terms of a proposed labor contract.

• Facebook Inc: The company apologized to users for a two hour disruption to its services on Friday and blamed another faulty configuration change for its second global outage this week. The company confirmed its social media platform, Instagram, Messenger and Workplace were impacted by the latest outage. "Sincere apologies to anyone who wasn't able to access our products in the last couple of hours," the company said. "We fixed the issue, and everything should be back to normal now." Both the outages piled pressure on Facebook this week after a former employee turned whistleblower accused the company on Sunday of repeatedly prioritizing profit over clamping down on hate speech and misinformation. Separately, a tech body backed by the Australian units of Facebook, Google and Twitter said it has set up a special committee to adjudicate complaints over misinformation, a day after the government threatened tougher laws over false and defamatory online posts.

• GlaxoSmithKline PLC & Vir Biotechnology Inc: The U.S. Food and Drug Administration said on Friday distribution of the jointly-developed antibody treatment for COVID-19 would be controlled by the government. The drug was authorized by the FDA in May but no supply deal was signed at the time with the U.S. government, which is already distributing rival treatments. The U.S. Department of Health and Human Services did not immediately respond to Reuters' request for comment. The drug, sotrovimab, belongs to a class of drugs called monoclonal antibodies, which mimic natural antibodies the body generates to fight off infection.

• Honeywell International Inc: The company on Sunday raised its outlook for business jet deliveries, as the aviation sector shakes off the effects of the COVID-19 pandemic and travel picks up with easing restrictions. The U.S. industrial conglomerate forecast up to 7,400 new business jet deliveries worth $238 billion from 2022 to 2031, up 1% from the same 10-year forecast a year ago. "The increased demand for used jets is estimated at more than 6,500 units over the next five years, putting pressure on an already record low inventory and driving additional demand for new jets," said Heath Patrick, president of Americas aftermarket for Honeywell Aerospace. Business jet operators surveyed by Honeywell reported a sharp increase in their used jet purchase plans, 12% above last year's report, the North Carolina-based company said.

• JPMorgan Chase & Co: The bank said it was joining the United Nation's Net-Zero Banking Alliance, a group of global banks that have committed to dramatically reducing their carbon financing and investment activities. As the largest U.S. bank and a major lender to the fossil fuel industry, JPMorgan has been criticized for not joining the group, which launched in April, sooner. The announcement comes ahead of next month's UN Climate Change Conference, known as COP 26, in Glasgow. "We are joining the Net Zero Banking Alliance because we support the ambition for greater climate action, the sharing of best practices and a collaborative approach between the public and private sectors to reach this goal," Marisa Buchanan, JPMorgan's global head of sustainability, said in a statement. Critics say the group's targets are too weak and flexible.

• KKR & Co Inc: KKR, Axa and Allianz will participate in an auction for a 49% stake in the fibre-optic subsidiary of Spanish grid operator Red Electrica, newspaper Expansion reported, citing unnamed sources. The subsidiary, known as Reintel, could fetch between 1.2 billion euros and 1.3 billion euros ($1.4 billion-$1.5 billion), Expansion said, citing financial sources. Red Electrica declined to comment, while KKR, Axa and Allianz did not immediately respond to requests for comment.

• Merck & Co Inc: The company said it has applied for U.S. emergency use authorization for its tablet to treat mild-to-moderate patients of COVID-19, putting it on course to become the first oral antiviral medication for the disease. Its authorization could help change clinical management of COVID-19 as the pill can be taken at home. The treatment, molnupiravir, could halve the chances of death or being hospitalized for those most at risk of contracting severe COVID-19, according to the drugmaker. Viral sequencing done so far have showed it is effective against all coronavirus variants, including Delta, Merck said. The interim efficacy data on the drug, which has been developed with Ridgeback Biotherapeutics, had heavily impacted the shares of COVID-19 vacine makers when it was released last week.

• Southwest Airlines Co: The airline cancelled at least 30% of its scheduled flights on Sunday, a second straight day of heavy cancellations, data from flightaware.com showed. Southwest declined to confirm the number of cancelled flights, saying only it had a significant amount over the weekend due to unfavorable weather in Florida that was compounded by air traffic control issues in the same region. "With fewer frequencies between cities in our current schedule, recovering during operational challenges is more difficult and prolonged," the airline said in a emailed statement. According to the flight tracking site, the airline has cancelled 1,103 flights so far on Sunday, which comes on top of 808 or 24% of scheduled flights on Saturday. The cancellation rate was much greater than those of other airlines. Southwest Airlines' pilots union denied speculation on social media that the cancellations were due to union action. The union had said on Oct. 5 it would file a temporary restraining order to stop Southwest complying with a COVID-19 vaccine mandate for federal contractors, which includes major airlines, that has been set by President Joe Biden.

• Tesla Inc: The first cars to emerge from the company's new Berlin factory should roll off the production line as early as next month, CEO Elon Musk said at the site of the plant on Saturday, but added that volume production would take much longer to achieve. Musk hopes to get the green light in coming weeks to start production at the site. The latest consultation on public concerns towards the site closes on Oct. 14, after which the Environment Ministry will make a decision. "Starting production is nice, but volume production is the hard part," Musk told a cheering audience at a festival at the plant site, many of whom livestreamed the speech on social media. "It will take longer to reach volume production than it took to build the factory." He said volume production would amount to 5,000 or "hopefully 10,000" vehicles per day, and battery cells would be made there in volume by the end of next year.

PREVIEW

U.S. earnings seen strong, but supply chains and costs worry investors

Investors are primed for another period of strong U.S. profit growth as third-quarter reports from Corporate America flow in. But as business continues to emerge from the coronavirus pandemic, new problems are arising that are taking center stage for Wall Street, including supply-chain snags and inflationary pressures.

ANALYSTS' RECOMMENDATION

• Chemocentryx Inc: Piper Sandler raises rating to overweight from neutral after the FDA approved Tavneos (avacopan) as an adjunctive treatment for adult patients with microscopic polyangiitis (MPA) and granulomatosis with polyangiitis (GPA).

• Dutch Bros Inc: Stifel initiates coverage with buy rating and $52 target price, saying the company’s impressive unit-level economics, expansion potential, and pace of development check all the boxes for a compelling restaurant growth investment.

• Eli Lilly and Co: Berenberg raises rating to buy from hold, saying with solid growth from marketed assets and a significant pipeline contribution, the company has locked in an average 10% pa sales growth through to 2030, more than double the peer-group average.

• Netflix Inc: Credit Suisse raises target price to $740 from $643 on expectation that the fourth quarter will start strong from Squid Game carryover, followed by the strongest-ever content slate for the rest of the quarter.

• Peloton Interactive Inc: Keybanc cuts target price to $155 from $185 based on the current valuation environment for digital fitness.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

1000 (approx.) Employment Trends for Sep: Prior 110.37

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

1030 Herman Miller Inc: Annual Shareholders Meeting

EX-DIVIDENDS

There are no major ex-dividends for the day.

Belangrijke week, markt moet nu richting kiezen

Goedemorgen,

De markt blijft volop in beweging, we zien dat er sector rotatie gaande is want de tech aandelen blijven onder druk staan terwijl de financiële waarden en de energie aandelen het juist goed doen. Zo te zien via de futures vanmorgen zal alles negatief van start gaan, kan alles nog draaien in de loop van de dag? We gaan het zien, het zal zoeken worden naar een mooi momentum om in te stappen met wat kleine posities maar door de volatiliteit en de juiste richting zien te kiezen kunnen we redelijk snel wat moois doen maar met geduld en met overzicht.

Update maandag 11 oktober:

Deze week wordt hoe dan ook belangrijk door dat de indices een richting moeten kiezen, ofwel het herstel door zien te zetten of er komt een nieuwe aanval omlaag om de bodems van vorige week te testen. De indices die er wat sterker voorstaan zijn de Dow Jones en de DAX, de AEX en de Nasdaq kunnen nog wat hinder ondervinden door dat de populaire aandelen uit de tech sector onder druk staan na vorige week. Denk dan vooral aan Apple, Amazon, Alphabet, Facebook en Microsoft. Binnen de chip sector zijn dat Nvidia en hier in Nederland ASML. Er kwam al een herstel vanaf de laagste stand maar vrijdag zien we toch weer wat druk op deze aandelen.

Wat betreft de volatiliteit, die blijft aanwezig want de bewegingen zijn groot gedurende de sessie en we zien ook dat er nog geen keuze kan worden gemaakt voor het vervolg. Aan de bovenkant zit het dicht door de weerstand terwijl aan de onderkant de bodem wacht en daar zien we ook een stevige steun nu. Tussen de bovenkant en de onderkant ligt er een ruim speelveld van enkele procenten en daarom kan de markt ruim bewegen tussen de steun en de weerstand. Het gaat ook snel, dat hebben we vorige week en ook de weken ervoor kunnen merken. Mindere sessies en stevige hersteldagen volgen elkaar snel op.

Waar beleggers nu naar kijken zijn de cijfers over de werkgelegenheid van afgelopen vrijdag en ook naar het verloop van de energieprijzen die de afgelopen weken fors zijn opgelopen. Dat brengt de angst voor inflatie volop terug en kan de rente doen oplopen, aan de andere kant zorgen de cijfers van afgelopen vrijdag voor hoop dat de centrale banken wat langer willen wachten met het afbouwen en het verhogen van de rente. Ook wat betreft het economische herstel kan er een vertraging komen juist door de dure energieprijzen, dat zal de winsten op een gegeven moment drukken.

We gaan zien wat de nieuwe week zal brengen, vanmorgen merken we meteen al dat de markt volatiel zal opstarten, de futures staan wat lager maar in Azië zien we vanmorgen hogere koersten.

Wel blijven opletten in deze markt waar er aan volatiliteit geen gebrek is, dit zijn fases waar je door de verkeerde keuzes te nemen of door te grof in de markt te zitten behoorlijk wat kunt verliezen. Ik zie en hoor via diverse kanalen dat het voor sommige beleggers niet goed afloopt want door de volatiliteit en het te lang blijven zitten bij verkeerde keuzes kan zoiets voor grote verliezen zorgen. Ik probeer mijn leden daarbij te begeleiden door voorzichtig met deze markt om te gaan.

We wachten dan ook rustig af, ik handel met kleine posities en zoek een zo goed mogelijke instap waardoor je ook een paar dagen in de markt kunt blijven zitten. Kleine posities beperken dan de schade als het de verkeerde kant op gaat maar men kan er ook best goed mee scoren door de volatiliteit als je wel de juiste richting hebt te pakken. Voorlopig zal ik deze strategie blijven volgen, pas als de rust wat terugkomt zal ik de posities wat groter kiezen.

Mij via Twitter volgen? Ga naar @USMarkets of https://twitter.com/USMarkets<...

Eerste posities oktober vorige week met winst gesloten:

Er lopen nu geen posities meer want de long posities heb ik met een mooie winst gesloten afgelopen donderdag. Mogelijk zal ik weer wat kleine posities opnemen in de loop van de dag of later deze week, u kunt meedoen door lid te worden.

Schrijf u nu in via de aanbieding tot 1 DECEMBER voor €35. Ga meteen naar onze tradershop via de link https://www.usmarkets.nl/trade... en schrijf u in ...

Marktoverzicht:

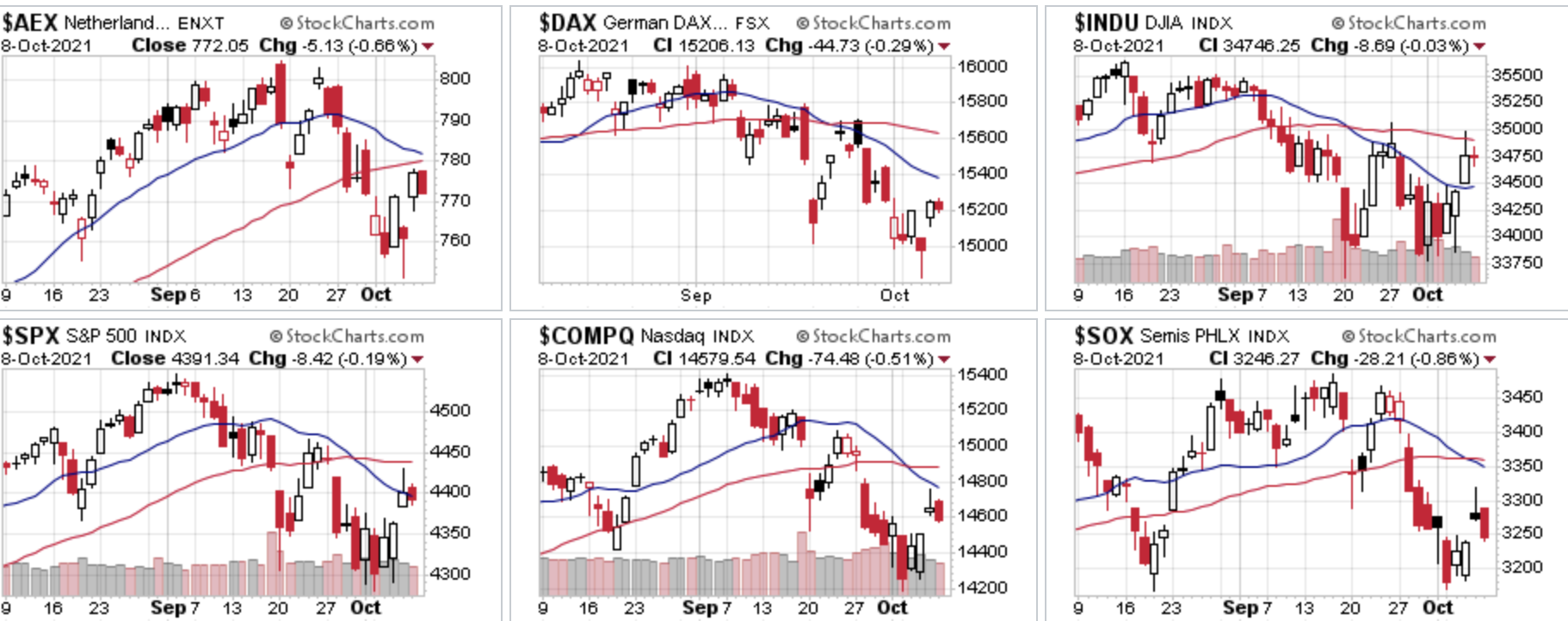

Via het marktoverzicht niet veel verandering vrijdag maar alle indices moeten wat inleveren, de grootste daling zien we bij de chip sector, de SOX verloor 0,85%. Verder verloor de AEX 0,65% en de Nasdaq 0,5% terwijl de Dow Jones gelijk bleef. De DAX sluit 0,3% lager, S&P 500 verloor 0,2%. Nog geen slecht teken, er werd wat van de winst ingeleverd en we moeten de komende week zien hoe het verder zal verlopen. De kans op een verder herstel zit er wel nog in maar dan moet er een uitbraak omhoog komen bij enkele indices.

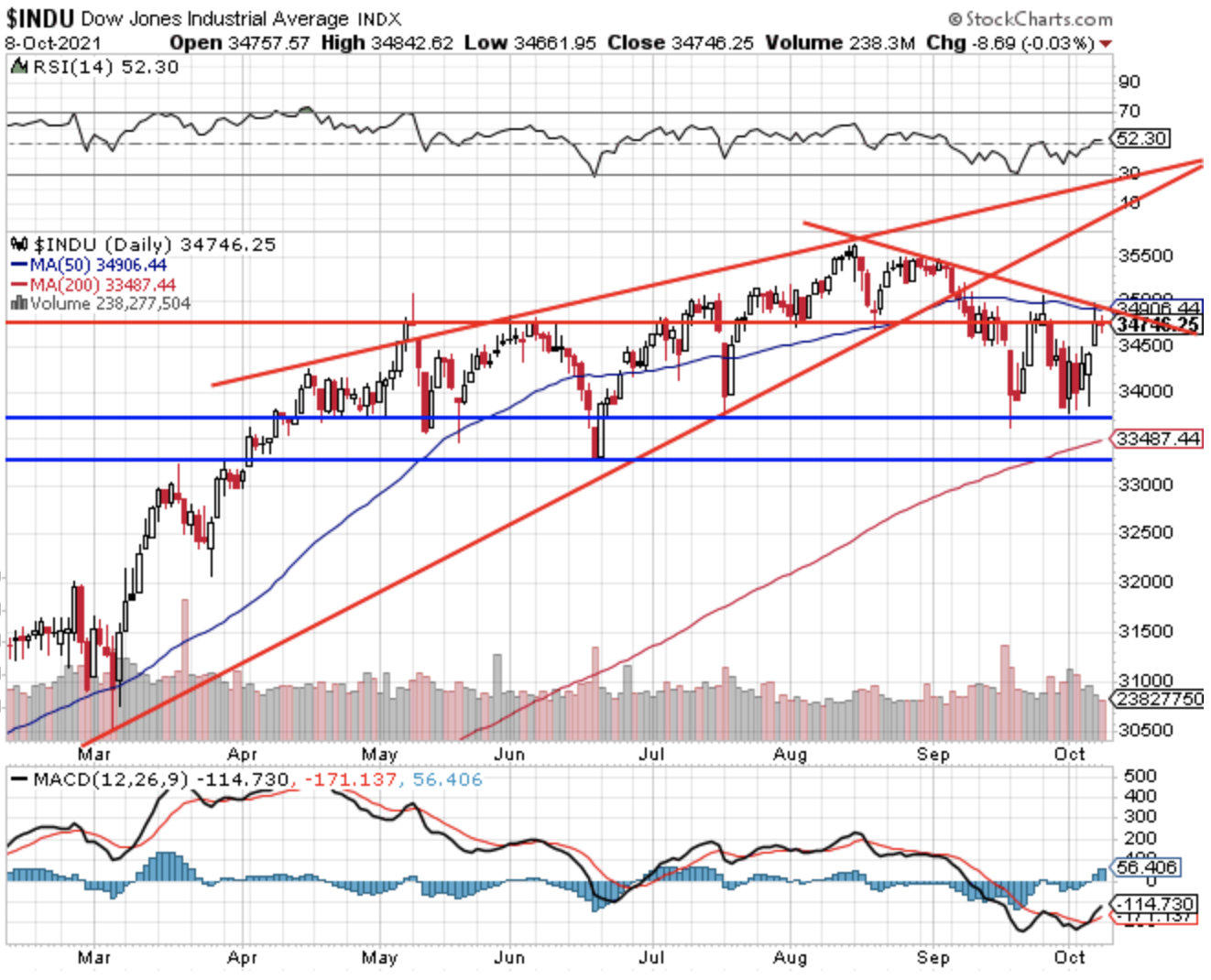

Dow Jones:

De Dow Jones herpakt zich duidelijk maar staat dicht bij een zware weerstand nu. We zien net als eind september dat de Dow Jones wel even boven het 50-daags gemiddelde breekt maar dat richting het slot dat niet vol weet te houden. Dat 50-MA wordt nu toch belangrijk de komende sessies samen met de lijn over de toppen, de index zal erdoor moeten breken om het herstel door te zetten.

Weerstand zien we nu rond de 34.900 punten, een niveau dat de index aan het testen is en waar ook het 50-daags gemiddelde uitkomt. Bij een verder herstel richten we ons op de 35.000 punten met daarboven de 35.250 en de 35.500 punten. De index is onderweg om uit te breken maar zo ver is het nog niet, eerst maar eens die 35.000 punten zien te halen nu. Steun eerst de 34.500 en de 34.250 punten, later de 33.750 punten ofwel de bodemzone als belangrijke steun.

AEX index:

De AEX moet wat terug maar op zich valt het mee omdat de index niet onder de 770-772 punten zakt. De index test nu voor de 2e dag op rij het 50-daags gemiddelde maar moet er nog boven zien te geraken. Het 50-MA komt nu uit rond de 779-780 punten.

Steun nu eerst de 770-771 punten met later de 760-762 punten, later de 755 en de 751 punten waar de index woensdag de bodem neerzette. Het is nu afwachten of de AEX zich verder kan herpakken, mogelijk kan de bodem er staan want de steunzone aan de onderkant werd duidelijk getest nu. Weerstand nu eerst het 50-MA rond de 779-780 punten, later de 790 punten en de bekende topzone tussen de 800 en de 805 punten.

DAX index:

De DAX herpakt zich gelukkig ook na de dip van donderdag tot ver onder de 15.000 punten waar de index zelfs even onder het 200-daags gemiddelde dook. We zien de index nu uitkomen op 15.200 punten waardoor de weg open ligt richting eerst de 15.300 en daarna richting de 15.500-15.550 punten waar de eerste zware weerstand wacht. Later het 50-daags gemiddelde dat rond de 15.640 punten uitkomt nu.

Steun nu het 200-MA dat rond de 15.030 punten uitkomt, later de bodem van woensdag rond de 14.800 en de 14.600 punten als steun.

Nasdaq Composite:

De Nasdaq moet wat inleveren maar na de stijging van de afgelopen dagen zie ik nog geen probleem. Wel opletten nu voor het vervolg want door de volatiliteit kan de markt nog een keer fors omlaag als de daling weer op gang komt. Aan de andere kant is het goed mogelijk dat alles weer een poging richting de weerstand inzet en dan kan er een uitbraak omhoog komen waardoor het vertrouwen weer toeneemt. De komende sessies worden hoe dan ook belangrijk en zeker voor de tech sector.

Weerstand zien we nu eerst rond de 14.775-14.800 punten, later het 50-daags gemiddelde rond de 14.880 punten. Eerst maar eens zien of deze niveaus worden bereikt. Later de 15.000 punten nog als belangrijke weerstand en die lijkt me zo te zien redelijk zwaar. Steun zien we rond de 14.575-14.600 punten, later de 14.400 en uiteraard die stevige en zeer belangrijke steun rond de 14.200 punten.

Overzicht resultaat september en dit jaar (2021):

We blijven vooral rustig te werk gaan en zoeken vooral naar kansen bij de indices om posities op te nemen waar er zich mogelijkheden voordoen. Er lopen nu geen posities maar de komende sessies zoek ik weer naar een momentum om in te stappen.

Om mee te doen met de nieuwe posities kan dat via het proefabonnement tot 1 december en voor €35. Deze maand en dit jaar staan we in ieder geval op een mooie winst en dat in een moeilijke markt. Wat ik doe is vooral tijd nemen en de rust bewaren, er komen dus weer mooie kansen aan.

Schrijf u nu in via de nieuwe aanbieding en dat is tot 1 DECEMBER voor €35. Ga meteen naar onze tradershop via de link https://www.usmarkets.nl/trade... en schrijf u in voor deze mooie aanbieding ...

Overzicht resultaten oktober en dit jaar (2021)

Met vriendelijke groet,

Guy Boscart