Liveblog Archief dinsdag 16 januari 2024

Pre-Market overzicht Wall Street (nieuws)

TOP NEWS

• Musk wants 25% voting control at Tesla before fulfilling AI goal

Tesla CEO Elon Musk said he would be uncomfortable growing the automaker to be a leader in artificial intelligence and robotics without having at least 25% voting control of the company, nearly double his current stake.

• Big US banks to call on Fed to rewrite contentious bank capital rule

Banks will urge the U.S. Federal Reserve to completely overhaul a draft rule hiking bank capital, in the latest leg of Wall Street's effort to water down the "Basel Endgame" proposal that bankers say will hurt the economy.

• Synopsys finalizes $35 billion deal to buy engineering software vendor Ansys-source

Design software maker Synopsys has finalized terms to acquire engineering software company Ansys for about $35 billion in cash and stock, two people familiar with the matter said.

• Microsoft CEO 'comfortable' with OpenAI non-profit despite Altman ouster

Microsoft CEO Satya Nadella said he had no issue with partner OpenAI's governance structure, two months after the startup's non-profit board temporarily ousted its chief executive without regard to investors' interests.

• YouTube making money off new breed of climate denial, monitoring group says

YouTube is making millions of dollars a year from advertising on channels that make false claims about climate change because content creators are using new tactics that evade the social media platform's policies to combat misinformation, according to a report published.

BEFORE THE BELL

Wall Street futures slipped on falling Apple and Tesla shares, while investors awaited U.S. bank earnings reports during the day. European equities fell as traders reined in rate cut expectations following hawkish remarks from ECB officials. In Asian equities markets, Japan's Nikkei snapped a six-day winning streak to end lower, while China stocks bucked the trend to close higher as investors looked to annual economic data expected on Wednesday. Gold prices retreated, weighed down by strengthening dollar and Treasury yields as markets awaited remarks from several Fed officials this week. Oil prices rose due to ongoing threats and attacks on Red Sea shipping.

STOCKS TO WATCH

Results

• HDFC bank Ltd: The bank posted a higher-than-expected standalone net profit for the third quarter ended Dec 31., bolstered by robust loan growth, it said. Analysts had expected a net profit of 156.51 billion rupees, LSEG data showed. It posted a standalone net profit, excluding its subsidiaries, of 159.76 billion rupees in the July-September quarter. The bank's net interest income, or the difference between interest earned and interest expended, stood at 284.71 billion rupees, up from 273.85 billion rupees in the previous quarter. This is HDFC Bank's second earnings report since its merger with parent Housing Development Finance Corp (HDFC) in July. The numbers are not comparable to a year ago when the lender and HDFC operated as separate firms.

Deal Of The Day

• Ansys Inc & Synopsys Inc: The design software maker has finalized terms to acquire the engineering software company for about $35 billion in cash and stock, two people familiar with the matter said. The transaction would be the biggest acquisition in the technology sector since chip maker Broadcom took over software maker VMware last November in a $69 billion deal. It could herald more big deals as a pick-up in economic sentiment and some failed attempts by antitrust regulators to thwart deals embolden chief executives to place large acquisition bets. Synopsys will pay about $19 billion in cash and $16 billion in Synopsys stock for Ansys, one of the sources said. The deal contract will be in effect for as long as 24 months to give the companies time to get the deal cleared by antitrust regulators, the source added. The deal values Ansys at slightly less than $400 per share and represents a roughly 30% premium to Ansys' closing share price on Dec. 21, the day before Reuters was first to report the two companies were in deal negotiations.

• Talos Energy Inc: The oil and gas company said on Monday it will acquire privately held QuarterNorth Energy in a $1.29 billion cash and stock deal to bolster its presence in Mexico. QuarterNorth is a privately held U.S. Gulf of Mexico exploration and production company with ownership in six major fields.Talos expects the acquisition to improve its base decline rate by approximately 20%. QuarterNorth Energy will receive about 24.8 million shares of Talos's common stock and about $965 million in cash. More than a dozen companies including Chevron and Repsol had quit offshore oil and gas exploration areas in Mexico last year after disappointing results. Only a handful of companies had made significant finds in the areas which included Talos. The company said it expects annual run-rate synergies of approximately $50 million by year-end 2024. The deal is expected to close by the end of first quarter of current year.

In Other News

• Alaska Air Group Inc: The airline has begun preliminary inspections on some of its Boeing 737-9 MAX aircrafts this weekend, adding that up to 20 planes could undergo inspection, the company said on Saturday. The carrier also said it would initiate and enhance its own layers of quality control to the production of the airplane and has initiated a review of Boeing’s production quality and control systems, including Boeing’s production vendor oversight. Alaska Airlines said that it engaged in a candid conversation with Boeing’s CEO and leadership team earlier in the week to discuss their quality improvement plans to ensure the delivery of the highest quality aircraft off the production line for Alaska. The airline said that the U.S. Federal Aviation Administration (FAA) will require more data from Boeing before it approves the airline manufacturer's proposed inspections and the maintenance instructions used to conduct the final inspections to safely return the 737-9 MAX to service.

• Albertsons Companies Inc & Kroger Co: The companies said on Monday that they plan close the proposed $24.6 billion merger in the first half of Kroger's fiscal 2024 instead of early 2024. The merger, first announced in October 2022, has drawn the ire of U.S. lawmakers and an investigation by the Federal Trade Commission due to antitrust concerns, with worries piling up that the deal would lead to higher prices for consumers, store closures and loss of jobs. "In light of our continuing dialogue with the regulators, we are updating our anticipated closure timeline," the companies said in a statement. In 2023, the first half of Kroger's fiscal year ended Aug. 12. Kroger said it will invest $500 million to reduce prices and $1.3 billion to enhance customer experience.

• Alphabet Inc: YouTube is making millions of dollars a year from advertising on channels that make false claims about climate change because content creators are using new tactics that evade the social media platform's policies to combat misinformation, according to a report published. The Center for Countering Digital Hate (CCDH) used artificial intelligence to review transcripts from 12,058 videos from the past six years on 96 of YouTube channels. The channels promoted content that undermines the scientific consensus on climate change that human behavior is contributing to long-term shifts in temperature and weather patterns, the report said. CCDH, a nonprofit that monitors online hate speech, said its analysis found that climate denial content has shifted away from false claims that global warming is not happening or that it is not caused by greenhouse gases produced from burning fossil fuels. Videos espousing such claims are explicitly banned from generating ad revenue on YouTube, according to Google's policy.

• Apple Inc: The smartphone maker is offering rare discounts on its iPhones in China, cutting retail prices by as much as $70 amid growing competitive pressure in the world's biggest smartphone market. The U.S. tech giant cut prices of some iPhones by 5%, its Chinese website showed on Monday. The time-limited promotion, branded as a Lunar New Year event, will last from Jan. 18 through Jan. 21 in a lead-up to the holiday in mid-February. Sales of Apple's latest iPhone 15 series of handsets have been far worse than previous models in China. Chinese iPhone sales dropped 30% in the first week of 2024 versus the same period a year earlier, Jefferies analysts said in a client note, having fallen 3% for all of 2023. Analysts expect the competitive landscape to get tougher this year. Apple has not cut prices for its latest iPhones in years. The cuts come after it surprised the market by not raising prices for the iPhone 15 series at its September launch. Separately, a U.S. law enforcement agency has determined that Apple can use a redesign to bypass an import ban on newer Apple Watch models stemming from its patent infringement dispute with Masimo, the medical-monitoring technology company said in a court filing on Monday.

• Blackstone Inc: The world’s largest asset manager will double its private equity business headcount in Singapore within the next two years, a top executive said, as it looks to tap into a growing number of deals in Southeast Asia. The expansion in Singapore will also bring the asset manager closer to its investor base, which includes sovereign wealth funds, family offices and individual investors, said Blackstone's Asia private equity (PE) business head Amit Dixit. Blackstone's Singapore PE team will grow to six or seven people within two years, and Aravind Krishnan, a managing director in its PE practice, will move to the city-state from Mumbai to lead that team, he added. Blackstone joins a growing of list of global asset managers expanding or setting up offices in Singapore as financial investors seek alternative bases to China amid growing geopolitical tensions and a sluggish economic recovery there.

• Boeing Co: The plane maker will add further quality inspections for the 737 MAX after a mid-air blowout of a cabin panel in an Alaska Airlines MAX 9 earlier this month, the head of its commercial airplanes division said on Monday. The planemaker will also deploy a team to supplier Spirit AeroSystems - which makes and installs the plug door involved in the incident - to check and approve Spirit's work on the plugs before fuselages are sent to Boeing's production facilities in Washington state, Stan Deal, president of Boeing Commercial Airplanes, said in a letter to Boeing employees. The new actions from Boeing come after the Federal Aviation Administration on Friday extended the grounding of 171 MAX 9 planes indefinitely for new safety checks. Only after 40 planes are inspected will the agency review the results and determine if safety is adequate to allow the MAX 9s to resume flying, the FAA said. Separately, Boeing faces a fresh delay in the resumption of deliveries of 737 MAX jets to China after the mid-air blowout of a panel on an Alaska Airlines MAX 9 this month, the Wall Street Journal reported on Sunday.

• Comcast Corp: South African pay TV company MultiChoice and the U.S. media conglomerate will offer African subscribers a standalone live Premier League soccer plan on mobile as part of its revamped Showmax video streaming platform. Africa's biggest pay TV company MultiChoice has been investing billions of rand to fight off competition from international streaming giants such as Netflix, Amazon and Disney, some of which have also been investing in local content. Last year the group entered into a partnership with Comcast’s NBCUniversal and Sky to revamp MultiChoice's existing Showmax streaming service, which will be built on NBCUniversal's Peacock streaming platform. Detailing the plans at the launch event on Monday, Showmax CEO Marc Jury said at the heart of the new offering was the standalone Premier League plan, which will allow Showmax subscribers in Africa to stream the league's content on their mobile phones for $3.70 a month.

• Deutsche Bank AG: The bank’s Chief Financial Officer James von Moltke believes consolidation would be healthy for the banking industry but says current conditions are not favorable, Bloomberg News reported. "For a long time, we have been proponents of consolidation in the industry but we have also said that conditions, preconditions have to be in place for that to happen," von Moltke told Bloomberg Television in an interview at the World Economic Forum in Davos. Von Moltke was responding to a question about a Bloomberg News report last week that Deutsche Bank has intensified internal discussions about deals involving European lenders such as Commerzbank AG ABN Amro Bank NV.

• Merck & Co Inc: The U.S. Food and Drug Administration (FDA) on Friday approved the expanded use of Merck’s blockbuster immunotherapy Keytruda in combination with chemoradiotherapy to treat newly diagnosed patients with a type of advanced cervical cancer. The Keytruda combination was approved for patients with cervical cancer who had not previously received surgery, radiation, or systemic therapy, FDA said. This makes Keytruda plus chemoradiotherapy the first anti-PD-1-based immunotherapy combination approved in the U.S. as a treatment for newly diagnosed patients with a certain type of cervical cancer, Merck said. Merck's top-selling drug Keytruda helps the body's own immune system fend off cancer by blocking a protein called PD-1. It has been approved to treat more than ten kinds of cancer.

• Microsoft Corp: The company’s CEO Satya Nadella said he had no issue with partner OpenAI's governance structure, two months after the startup's non-profit board temporarily ousted its chief executive without regard to investors' interests. "I'm comfortable. I have no issues with any structure," Nadella said at a Bloomberg News event on the sidelines of the World Economic Forum's annual meeting in Davos. The surprise November dismissal of OpenAI's CEO Sam Altman over an alleged communication breakdown triggered a crisis at the startup behind ChatGPT, in which employees threatened to resign en masse and go work for Microsoft, which is backing OpenAI with billions of dollars. Separately, Microsoft on Monday said consumers and small businesses can buy subscriptions to access more capabilities in its artificial intelligence "Copilot," as it moves to grow sales beyond large enterprises.

• Microsoft Corp & Vodafone Group Plc: The telecom company has agreed a 10-year partnership with Microsoft to bring generative AI, digital, enterprise and cloud services to more than 300 million businesses and consumers across its European and African markets. The British company will invest $1.5 billion in customer-focused AI developed with Microsoft's Azure OpenAI and Copilot technologies, it said, and will replace physical data centres with cheaper and scalable Azure cloud services. Microsoft will in turn become an equity investor in Vodafone's managed IoT (Internet of Things) platform when it is spun out as a standalone business by April 2024, and help scale Vodafone's mobile financial platform in Africa. Vodafone's Chief Financial Officer Luka Mucic said Microsoft's leadership in AI, underpinned by its OpenAI partnership, would transform the telco's customer services.

• Nvidia Corp: Chinese military bodies, state-run artificial intelligence research institutes and universities have over the past year purchased small batches of the company’s semiconductors banned by the U.S. from export to China, a Reuters review of tender documents show. The sales by largely unknown Chinese suppliers highlight the difficulties Washington faces, despite its bans, in completely cutting off China's access to advanced U.S. chips that could fuel breakthroughs in AI and sophisticated computers for its military. Buying or selling high-end U.S. chips is not illegal in China and the publicly available tender documents show dozens of Chinese entities have bought and taken receipt of Nvidia semiconductors since restrictions were imposed. These include its A100 and the more powerful H100 chip - whose exports to China and Hong Kong were banned in September 2022 - as well as the slower A800 and H800 chips Nvidia then developed for the Chinese market but which were also banned last October.

• Rio Tinto Plc: The company said its Dampier Salt joint venture will sell the Lake MacLeod salt and gypsum operations in Western Australia to Leichhardt Industrials Group, which is backed by former Dow Chemical boss Andrew Liveris, for $251 million. Leichhardt Industrials will be snapping up the Lake MacLeod business which is one of three solar salt operations under Dampier Salt - the world's largest exporter of seaborne salt. "The sale of Lake MacLeod will enable Dampier Salt to focus on enhancing operational efficiencies at its remaining two Pilbara operations, while allowing the new owner of Lake MacLeod to maximise its potential," said Rio Tinto’s managing director of port, rail and core services, Richard Cohen.

• Shell Plc: The British energy major has agreed to sell its Nigerian onshore oil and gas subsidiary in Nigeria to a consortium of five mostly local companies for up to $2.4 billion, after nearly a century of operations there. Active in the West African country since the 1930s, Shell has struggled for years with hundreds of oil spills at its onshore operations as a result of theft, sabotage and operational issues that led to costly repairs and high-profile lawsuits. It has sought to sell its Nigerian oil and gas business since 2021, but will remain active in Nigeria's more lucrative and less problematic offshore sector. Shell will sell The Shell Petroleum Development Company of Nigeria Limited (SPDC) for a consideration of $1.3 billion, it said in a statement, while the buyers will make an additional payment of up to $1.1 billion relating to prior receivables at completion.

• Sigma Lithium Corp: BYD has held talks with Brazilian company over a possible supply agreement, joint venture or acquisition, the Financial Times reported on Sunday. BYD met Sigma Chief Executive Ana Cabral Gardner in Sao Paulo last month, BYD's Brazilian chair, Alexandre Baldy, told the newspaper, but did not give details, citing a confidentiality agreement. Sigma said in January it had initiated a primary listing of Sigma Brazil on Nasdaq and the Singapore stock exchange. BYD, backed by Warren Buffet's Berkshire Hathaway, said in July it would invest $600 million in a new industrial complex in northeastern Brazil, with operations expected to start in mid-2024.

• Taiwan Semiconductor Manufacturing Co Ltd: The company is expected to report a 23% drop in fourth-quarter profit on Thursday, but analysts predict better growth this year on the back of rebounding demand. The world's largest contract chipmaker is set to report net profit of T$226.4 billion ($7.21 billion) for the October to December period - its third straight quarter of profit decline, according to an LSEG SmartEstimate drawn from 20 analysts. SmartEstimates give greater weighting to forecasts from analysts who are more consistently accurate. That compares to the year-earlier net profit of T$295.9 billion. Revenue in the final three months of last year came in at $20.10 billion, according to Reuters calculations from TSMC data released last week, compared with $19.93 billion in the year-earlier period, but that still beat both the company's and market's expectations. TSMC is due to report at 0600 GMT on Thursday.

• Tesla Inc: Elon Musk said he would be uncomfortable growing the automaker to be a leader in artificial intelligence and robotics without having at least 25% voting control of the company, nearly double his current stake. Musk said on Monday in a post on social media platform X, formerly known as Twitter, that unless he got stock in the world's most valuable automaker that was "enough to be influential, but not so much that I can't be overturned", at Tesla, he would prefer to build products outside of the electric-vehicle manufacturer. He has long touted Tesla's partially automated "Full Self-Driving" software and its prototype humanoid robots but the electric-vehicle maker generates most of its revenue from its automotive business. Some analysts have also pegged the technologies, including Tesla's Dojo supercomputer to train AI models, as drivers of the EV maker's valuation, with Morgan Stanley analyst Adam Jonas saying in September that Dojo could boost its market value by almost $600 billion.

• Thomson Reuters Corp: The company raised its offer to buy Sweden's Pagero by 25% to about $789 million and said it now controls about 54% of the company, seeking to ward off rival bids for the e-invoicing and tax solutions firm. Thomson Reuters said it increased its offer to 50 crowns per Pagero share, valuing the company at 8.1 billion crowns and topping an offer of 45 crowns per share from U.S.-based sales and tax management services company Avalara Inc. Thomson Reuters said it has bought about 53.81% of Pagero's shares and votes from key shareholders, including Summa Equity as well as Pagero CEO and other company executives and employees at the new offer price, which is for all Pagero shareholders. Last week, Thomson Reuters had offered 40 crowns per share, valuing Pagero at 6.4 billion crowns, beating an offer of 36 crowns per share from U.S. tax technology firm Vertex. Vertex withdrew its offer on Sunday.

• Toyota Motor Corp: The carmaker plans to announce in about a month steps to overhaul its small-car specialist Daihatsu Motor after an investigation into misconduct at its unit related to rigged collision-safety tests found issues going back decades. "We're taking this very seriously," Toyota CEO Koji Sato told reporters. Toyota will consider whether to break down any boundaries between its business and that of Daihatsu as part of the move, he said, adding that it may dispatch engineers to its wholly owned subsidiary. Another potential measure includes a change to Daihatsu's leadership structure, Sato said. Production at Daihatsu's factories in Japan remains halted since late last month after an independent panel that had been investigating the company found issues involving 64 models, including almost two dozen sold under Toyota's brand.

• Tractor Supply Co: Deliveries for the U.S. retailer have been delayed anywhere from two to 20-plus days as major container ship operators re-route vessels away from the Suez Canal, Colin Yankee, the company’s chief supply chain operator, said on Friday. Ocean carriers are also adding diversion surcharges on cargo routed away from the Suez Canal to a safer route around South Africa’s Cape of Good Hope, according to Yankee. Higher shipping costs, extended travel times, and additional pain points, including reduced crossings on the drought-stricken Panama Canal, are leading Tractor Supply to “see potential for volume that was moving from Asia to the U.S. East Coast to shift to the U.S. West Coast throughout the year,” he told Reuters. However, Yankee said the rural retailer, which operates more than 2,000 stores across the U.S., is still in a “strong position” for the upcoming spring selling season. Most product destined for store shelves has already arrived in or is scheduled to land soon at U.S. ports.

ANALYSIS

Coming flood of US Treasury issuance unsettles some investors after blazing rally

Cracks are forming in the market’s bullish consensus for bonds, as resurfacing fiscal concerns duel with expectations that cooling inflation will push the Federal Reserve to cut interest rates in coming months.

ANALYSTS' RECOMMENDATION

• Boston Beer Company Inc: Bernstein raises target price to $335 from $280, expecting continued growth of its Twisted Tea beverage.

• Dutch Bros Inc: Stifel raises rating to buy from hold, as the new leadership is likely to guarantee meaningful progress.

• Fortinet Inc: Wells Fargo cuts rating to equal weight from overweight, citing the likely impact of weak demand for SASE technology.

• Home Depot Inc: Piper Sandler raises target price to $400 from $311, on its Pro business’s improving sales and infrastructure.

• Penumbra Inc: Piper Sandler raises target price to $310 from $250, expecting strong growth in its domestic venous blood clot treatment market.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 NY Federal Manufacturing for Jan: Expected -5.00; Prior -14.50

COMPANIES REPORTING RESULTS

Goldman Sachs Group Inc: Expected Q4 earnings of $3.51 per share

Morgan Stanley: Expected Q4 earnings of $1.01 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0830 Morgan Stanley: Q4 earnings conference call

0930 Goldman Sachs Group Inc: Q4 earnings conference call

1100 PNC Financial Services Group Inc: Q4 earnings conference call

EX-DIVIDENDS

AT&T Inc: Amount $0.33

EOG Resources Inc: Amount $0.91

Quest Diagnostics Inc: Amount $0.71

Records blijven binnen bereik, wel lagere futures vanmorgen

Beste beleggers, beursvolgers ...

De week kan nu echt beginnen nu Wall Street weer mee doet na de vrije dag van gisteren. Europa verloor wat maandag en we zien dat de futures lager staan vanmorgen. Vanmiddag krijgen we cijfers van enkele zakenbanken, dat zijn Goldman Sachs en Morgan Stanley, na de cijfers van Citigroup en JP Morgan afgelopen vrijdag die niet al te goed waren is het afwachten wat de reactie op deze cijfers zal worden. De 10 jaar rente doorbreekt vanmorgen weer de 4% na er vrijdag onder te duiken, de rente blijft al een tijdje rondom die 4% draaien. Verder zien we dat de Brent olie rond de 78,2 dollar staat vanmorgen, de euro zien we rond de 1,092 dollar. We hebben geen posities open staan nu, we zoeken naar een instap maar het is nu wat lastig. We hoeven niet snel weer wat te doen, de afgelopen 2 weken hebben we al wat leuke transacties kunnen doen en die zetten het resultaat voor deze maand op een mooie plus. Belangrijk is om de winst uit te breiden maar vooral zo te houden. Eerst maar eens bekijken hoe de markt zich zal gedragen de komende sessies en pas instappen zodra we een goed momentum krijgen ...

Voor wie graag een tijdje één van onze signaaldiensten wil volgen kan nu gebruik maken van onze proefaanbieding. U kunt dan een abonnement proberen tot 1 maart 2024. Systeem Trading voor €35, Guy Trading voor €40, Polleke Trading voor €45 en COMBI-Trading voor €75. Kijk vooral even een tijdje met ons mee en beslis daarna of het bij u past ... Schrijf u in via de link https://www.usmarkets.nl/trade...

Marktupdate 16 januari:

In Europa zien we maandag wat verlies, de AEX index sluit uiteindelijk 2,37 punten (0,3%) lager terwijl de DAX met 82 punten (0,5%) terug moest. De CAC 40 sluit 53 punten (0,72%) lager terwijl de BEL 20 maandag 0,5% verloor. Wat betreft Europa, een wat mindere start van de week maar de indices blijven dicht bij hun topzone uitkomen, een paar sterke sessies en er komt bij de DAX een nieuw record op de borden. Zo ver is het nog niet, het cijfers seizoen moet nog op gang komen wat betreft Europa.

Wall Street bleef maandag dicht door Martin Luther King Day, de indices op Wall Street zijn vrijdag wel verdeeld geëindigd, waarbij financials en luchtvaartmaatschappijen in het bijzonder onder druk stonden. Over de gehele week wonnen alle indexen in New York wel en komen opnieuw dicht bij hun hoogste standen ooit. Wel zien we vanmorgen lagere futures dus de opening kan lager worden. De vraag is dan of we in plaats van naar short posities uit te kijken moeten kiezen voor long posities. De topzone die bijna werd bereikt zal nog wel worden opgezocht en er kan zelfs een doorbraak komen met nieuwe records nu we er zo dicht bij staan.

Het Amerikaanse kwartaalcijfers seizoen kende vrijdag wel een valse start met matige resultaten bij de grote zakenbanken. Ook de cijfers van UnitedHealth en Delta Air Lines vielen tegen. Laten we dat in ieder geval opslaan voor het vervolg, echt betrouwbaar ziet het er tot nu toe niet uit en het zal zijn weg nog wel vinden later als de euforie zich wat terugtrekt.

De beurzen staan op dit moment naar mijn mening veel te hoog naar hetgeen we krijgen qwa resultaat van de bedrijven. De gemiddelde winstverwachting volgens analisten zou 18% lager moeten uitkomen dan de resultaten van 1 jaar geleden. Toen stond bijvoorbeeld de Dow Jones zo'n 4000 punten lager, de Nasdaq zo'n 3800 punten lager en de S&P 500 zo'n 800 punten lager. Het is maar een gegeven maar wel iets om ons in te beelden. Er moet iets niet goed zitten wat betreft de huidige ontwikkeling van de markten.

Wall Street op weekbasis, indices blijven dicht bij records:

De rally op Wall Street na de slechte start van het jaar kwam afgelopen maandag op gang en breidde de winsten over de week rustig verder uit. Uiteindelijk sloot de Dow Jones afgelopen week met een kleine winst van 0,3%, de index bereikte afgelopen vrijdag wel even een recordhoogte maar kon dat niveau niet vasthouden. Opvallend was dat Boeing bijna 13% kelderde na de problemen met de 737 Max toestellen die aan de grond moesten blijven en dat remde de winst van de Dow Jones index behoorlijk af.

De S&P 500 steeg op weekbasis met 1,8% en bereikte het hoogste punt in 52 weken en kwam zo wel heel dicht bij het hoogste punt ooit. Opletten voor wat betreft ook deze index die naar dat record wordt toegezogen. De Nasdaq deed het nog wat beter na de slechte start van het jaar de week ervoor, de Nasdaq steeg met 3,1% op weekbasis. De Nasdaq 100 staat nog altijd dicht bij het recordniveau, ook daar moeten we de komende dagen op gaan letten.

Kwartaalcijfers:

Vanaf vandaag krijgen we opnieuw kwartaalcijfers binnen van enkele grote zakenbanken, dan presenteren onder andere Goldman Sachs en Morgan Stanley hun resultaten. Hieronder ziet u via de tabel een overzicht van wanneer de bedrijven die met cijfers komen deze week.

Economie en cijfers:

Vandaag krijgen we de inflatie binnen uit Duitsland, woensdag krijgen we de inflatiecijfers uit Europa. Verder staan er deze week nog wat belangrijke cijfers op de agenda uit de VS.

Signaaldiensten 2024:

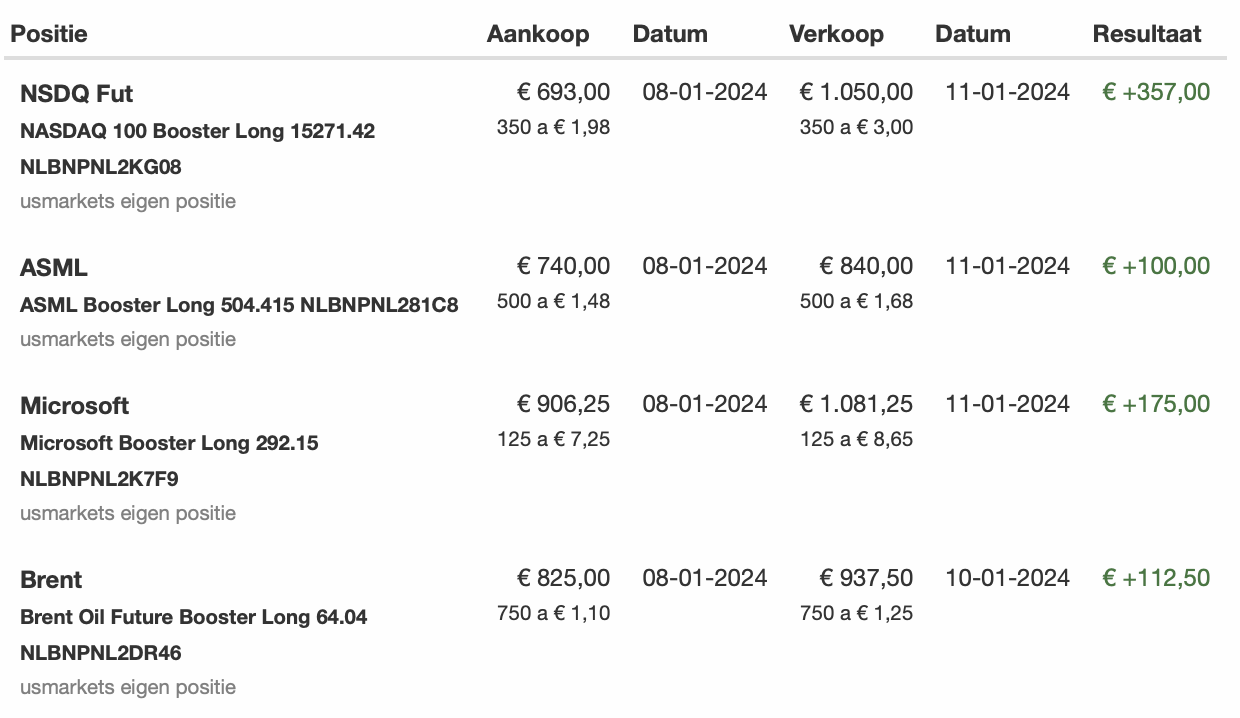

Afgelopen donderdag in de ochtend hebben we winst genomen op onze long posities, zo ronden we dit jaar al 6 posities (ofwel al iedere positie die we hebben opgenomen dit jaar) af met winst. We zijn op weg om de maand positief af te sluiten, de nieuwe manier van werken gaat tot nu toe goed omdat we bredere keuzes kunnen maken. We zien alle posities dan ook onafhankelijk van elkaar en we kunnen meer switchen tussen aandelen, indices, grondstoffen en eventueel ook valuta. We bekijken de markt rustig deze week, waar het kan zullen we wat doen.

Vanaf dit jaar werken we ook met een wat hoger bedrag wat er voor zorgt dat we meer en waar het kan wat grotere posities kunnen opnemen. Bij Systeem Trading kunnen we tot pakweg 5 posities gelijktijdig opnemen, bij Guy Trading tot 8 posities gelijktijdig. Onafhankelijk van elkaar en sommige posities kunnen zo wat langer doorlopen terwijl we met andere posities meer ruimte krijgen om wat korter op de bal te spelen. Het wordt totaal anders en zo zijn we niet meer alleen afhankelijk van alleen maar de indices.

Volg ons in ieder geval tot 1 MAART via de aanbieding vanaf €35, ga naar https://www.usmarkets.nl/trade... en schrijf u snel in zodat u niets hoeft te missen.

Rente 10 jaar VS:

De 10 jaar rente in de VS staat vanmorgen rond de 4%. Weerstand nu eerst rond die 4% met later de 4,1%, steun nu rond de 3,9% en de bodem rond de 3,78%.

Olieprijs:

Vanmorgen komt de Brent olie uit rond de 78,2 dollar en komt zo uit net boven de 77-78 dollar waar we eerder steun en weerstand zien. Steun zien we nu rond die 77-78 dollar, later steun rond de 74-75 dollar met daaronder de 72-73 dollar.

Weerstand nu eerst rond de 80 dollar met daarboven de bekende 82 dollar als mogelijk doel.

We handelen via zowel Systeem Trading, Guy Trading en COMBI-Trading op het verloop van de Brent olie, we hebben vorige week al winst kunnen nemen op een positie op de Brent olie.

Indicatie markt voorbeurs:

Vanmorgen zien we dat de futures zowel op Wall Street als in Europa lager uitkomen. De rente in de VS komt vanmorgen uit rond de 4%, de Brent olie staat vanmorgen rond de 78,2 dollar. De euro zien we vanmorgen rond de 1,092 dollar.

In Azië zien we vanmorgen lagere koersen met de Nikkei index die 0,65% lager sluit, de Hang Seng index staat zo'n 2% lager.

Analyse AEX:

De AEX sluit maandag met 2,37 punten (0,3%) verlies en komt nu uit op 779,5 punten. De index breekt nog niet door richting de 790-800 punten hetgeen wel nodig is om die 800 punten grens echt aan te vallen.

De eerste belangrijke steun zien we nu uit rond de 779-780 punten, later de 775 punten als steun. Verder letten we op de 770-771 punten als steun, verder vooral de 765 punten als de index weer naar beneden uitbreekt.

Weerstand nu eerst rond de 785-786 punten met daarboven de 790 punten en de topzone die rond de 795-798 punten uitkomt.

We handelen via onze signaaldiensten vaak op de AEX index. Om de signalen te ontvangen kunt u lid worden. Schrijf u in via de link https://www.usmarkets.nl/tradershop en ontvang onze signalen en updates tot 1 maart ...

Grafiek AEX:

Analyse Nasdaq 100:

De Nasdaq 100 won vrijdag na een volatiele sessie 12 punten (0,07%). Het slot komt nu uit op 16.833 punten. De Nasdaq 100 blijft op zoek naar de topzone ofwel de hoogste stand ooit die eind vorig jaar werd bereikt en op 16.968 punten uitkomt. Nog zo'n 130 punten te gaan ofwel iets minder dan 1%.

Steun nu eerst rond de 16.700 punten, later zien we steun rond de 16.600 en de 16.500 punten. Verder nog steun rond de 16.400 punten en de 16.225 punten. Weerstand krijgen we nu eerst rond de 16.900 punten, daarboven de topzone ofwel de hoogste stand ooit die we op 16.968 punten zien uitkomen als doel. Later weerstand rond de 17.000 en de 17.150 punten.

De RSI staat nu rond de 63, de MACD staat boven de 0-lijn.

Om mee te doen met onze signalen op de Nasdaq 100 index kunt u nu gebruik maken van onze aanbieding tot 1 maart. Schrijf u meteen in via onze Tradershop op de website, de link daarvoor is https://www.usmarkets.nl/trade...

Grafiek Nasdaq 100:

Analyse DAX:

De DAX sluit met 82 punten (0,5%) verlies maandag en komt nu uit op 16.622 punten. Weerstand nu eerst rond de 16.800 punten, daarboven zien we meteen de 17.000 punten ofwel de topzone als weerstand.

Steun nu eerst rond de 16.600 punten, later steun rond de 16.500 en de 16.400 punten.

De indicatoren verzwakken nu met de RSI die rond de 56 uitkomt, de MACD draait verder naar beneden toe.

We handelen via onze signaaldiensten vaak op de DAX index. Om de signalen te ontvangen kunt u lid worden. Schrijf u in via de link https://www.usmarkets.nl/tradershop en ontvang onze signalen en updates tot 1 maart ...

Grafiek DAX:

Analyse Dow Jones:

De Dow Jones sluit vrijdag 118 punten (-0,31%) lager en komt nu uit op 37.593 punten, de Dow Jones kruipt zoals we zien via de chart hieronder nog altijd richting de hoogste stand ooit, deze top wacht rond de 37.789 punten ofwel zo'n 195 punten verder.

Weerstand zien we nu eerst rond de topzone 37.775-37.800 punten, later weerstand rond de 38.000 en de 38.250 punten.

Steun nu eerst rond de 37.500 punten met daaronder de 37.300 en de 37.000 punten. Verder zien we steun rond de 36.750 punten.

De RSI komt nu uit rond de 64 terwijl we de MACD nog altijd negatief draait.

We handelen via onze abonnementen vaak op de Dow Jones index. Om de signalen te ontvangen kunt u lid worden. Schrijf u in via de link https://www.usmarkets.nl/tradershop en ontvang onze signalen en updates tot 1 maart ...

Grafiek Dow Jones:

Handelen met Turbo's of Boosters op indexen en aandelen?

Voor wie een tijdje een signaaldienst wil volgen dan kunt u nu gebruik maken van de proefaanbieding. Een abonnement kunt u nu volgen tot 1 MAART 2024, Systeem Trading voor €35, Guy Trading voor €40, Polleke Trading voor €45 en COMBI-Trading kan nu voor €75 !! Kijk vooral even een tijdje met ons mee en beslis daarna of het bij u past ...Schrijf u in via de link https://www.usmarkets.nl/tradershop en dan staat u snel op onze lijst met leden ...

We hebben de eerste posities van dit jaar al met winst kunnen sluiten zodat we het jaar in ieder geval positief starten. Zie hieronder de laatste transacties en het resultaat van de maand januari. In de loop van de week kunnen we mogelijk opnieuw instappen met wat posities op de indices, aandelen en de Brent olie. De leden krijgen op tijd bericht daarover ...

De laatste transacties bij Systeem Trading deze maand:

Resultaat deze maand (januari)

Met vriendelijke groet,

Guy Boscart